UTFA President’s Blog

October 29, 2018

Cynthia Messenger

The following, taken from UTFA’s town hall presentations and FAQs, offer information about other jointly sponsored pensions plans in Ontario, in comparison with the proposed UPP.

A. Ontario JSPPs—how the UPP would compare

- UPP would be mid-sized JSPP (about the same size as OPTrust)

- Much smaller than Teachers, OMERS, and HOOPP;

- Bigger than CAAT and the TTC plan.

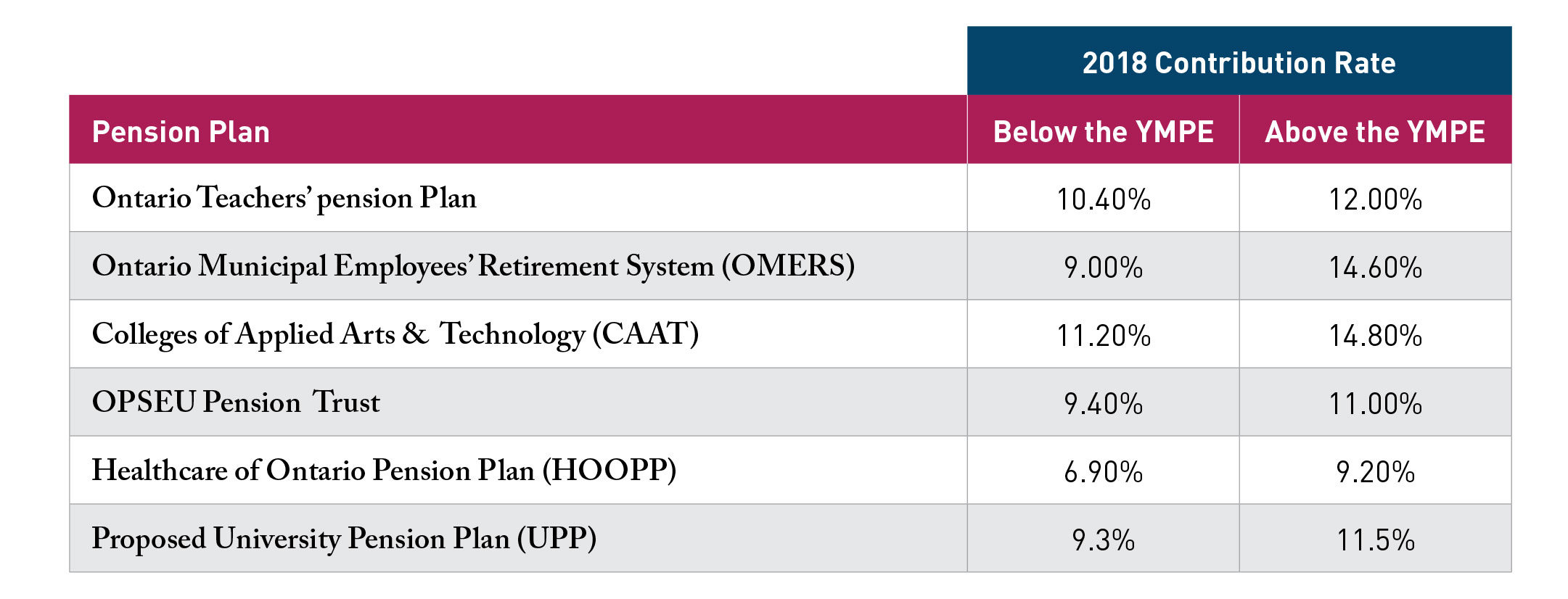

- UPP second lowest contribution rate (HOOPP has lowest)

- JSPP benefits vary, depending on the characteristics of plan membership

- UPP provides largest benefit accrual rate

- Standard survivor benefits range from 50% to 66 2/3%

- All JSPPs except OPTrust have or are considering conditional indexing

- Teachers has significant and expensive early retirement benefits

- UPP uses best 48 months of earnings, most other JSPPs have best 5-year average

B. The 2018 member contribution rates are provided in the following table:

__________________